The 8th World Islamic Economics and Finance Conference (WIEFC), held at Minhaj University Lahore from 25th to 26th January 2025, marked a groundbreaking milestone in the global discourse on Islamic finance.

Attended by over 2,000 participants, the conference united esteemed delegates and renowned experts from leading institutions around the world, including Australia, Bahrain, Brunei, Egypt, France, Iran, Libya, Malaysia, New Zealand, Nigeria, Pakistan, Qatar, Saudi Arabia, the United Kingdom and the United States.

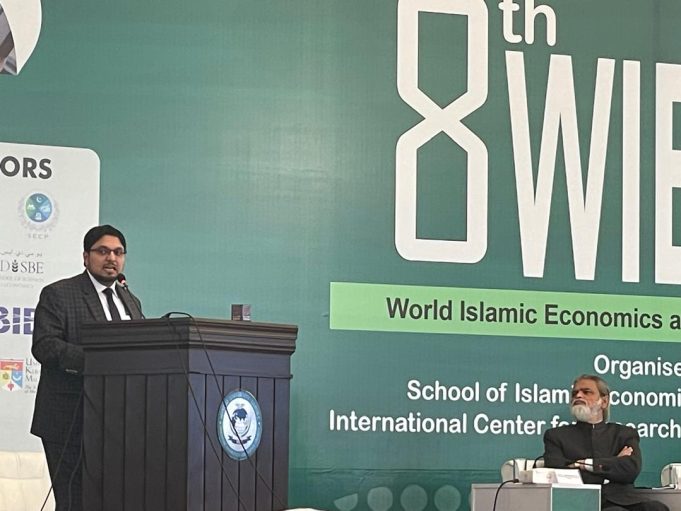

Among the many highlights, the keynote address delivered by Prof. Dr. Hussain Mohi-ud-Din Qadri, Professor of Economics and Deputy Chairman of the Board of Governors at Minhaj University Lahore, stood out as a defining moment of the conference. His speech, titled “Building a Future-Ready Islamic Finance Ecosystem in Pakistan,” presented a comprehensive and visionary framework that tackled current challenges and outlined strategic pathways for the future of Islamic economics.

Dr. Hussain opened his address by revisiting the legal and constitutional trajectory of Islamic finance in Pakistan. He highlighted the historical efforts to eliminate Riba (interest), tracing them back to the constitutional enshrinement of this principle in Article 38(f).

From the early steps in the 1980s to the groundbreaking Federal Shariat Court (FSC) ruling in 2022 and the 26th Constitutional Amendment in 2024, the journey has been marked by both progress and challenges. These legal milestones form the backbone of Pakistan’s commitment to aligning its financial systems with Islamic principles.

Dr. Hussain emphasized that the prohibition of Riba is not merely a legal or procedural requirement but a fundamental transformation aimed at achieving economic justice, fairness, and communal welfare. He cautioned against the superficial replication of conventional financial products under the guise of Shariah compliance. Instead, he advocated for genuine Islamization that reshapes financial systems to embody ethical and social values.

After decades of legal battles and partial reforms, the Pakistan’s Federal Shariat Court delivered its comprehensive judgment on April 28, 2022. The decision, authored by Justice Dr. Syed Muhammad Anwer, set a five-year timeline for Pakistan to eliminate Riba from its financial system.

This judgment served as a watershed moment in the legal and economic history of Pakistan, reaffirming the nation’s commitment to Islamic principles. Justice Dr. Anwer’s contributions to this monumental decision earned him the Lifetime Achievement Award from WIEFC, recognizing his pivotal role in shaping the future of Islamic finance in Pakistan.

In response to the Federal Shariat Court’s judgment, Pakistan’s Parliament passed the 26th Constitutional Amendment in October 2024. This amendment made the elimination of Riba a constitutional obligation, revising Article 38(f) to state that Riba must be eliminated by January 1, 2028.

Key highlights of this amendment include:

(1) Legislative incorporation of the FSC’s directive, ensuring legal and constitutional backing for the financial transformation.

(2) Recognition of the government’s commitment to aligning the financial system with Islamic teachings, strengthening the legal framework for reform.

(3) A consensus-driven political approach, with unanimous approval reflecting broad support for the initiative.

Key Challenges and Strategic Insights

One of the most daunting challenges identified was the transformation of public debt into Shariah-compliant structures. Dr. Hussain proposed innovative solutions such as asset-backed Sukuk and profit-and-loss sharing arrangements to replace interest-based borrowing. He stressed the need for robust research and development (R&D) to design these instruments and highlighted the critical role of Islamic banks in driving this transformation.

Dr. Hussain underscored that the ultimate success of Islamization lies in its social impact. Islamic finance must go beyond compliance to address real-world challenges like poverty, inequality, and financial exclusion. He called for a focus on small businesses, micro-enterprises, and the agricultural sector, ensuring that the benefits of Islamic finance reach marginalized communities. This aligns with the broader Islamic principles of economic justice and communal welfare.

The keynote address placed significant emphasis on human capital as the cornerstone of genuine Islamization. Dr. Hussain highlighted the acute shortage of skilled professionals in Pakistan’s Islamic finance sector and the pressing need for education and training programs that integrate Shariah principles with modern financial practices. He drew inspiration from Malaysia’s holistic approach to Islamic finance education, urging Pakistan to establish similar institutions and initiatives to bridge the talent gap.

Visionary Roadmap for a Future-Ready Ecosystem

Dr. Hussain proposed a multi-pronged approach to building a sustainable Islamic finance ecosystem in Pakistan:

(1) National Islamic Finance Development Fund (NIFDF): A dedicated fund to support R&D, curriculum development, and capacity-building initiatives. The fund’s inclusive governance model ensures representation from regulators, academia, industry, and Shariah scholars.

(2) Collaborative Framework for Islamic Finance Development: Transitioning from isolated centers of excellence to a national framework that unites academia, industry, and regulators. This ensures inclusivity, dynamic evaluation, and merit-based growth.

(3) Curriculum and Faculty Development: Standardized curricula that incorporate emerging trends like fintech and ESG principles, along with faculty training programs to enhance teaching and research capabilities.

(4) Industry-Academia Synergy: Structured internship programs, joint research projects, and co-development of innovative financial products to bridge the gap between academic knowledge and practical application.

(5) Regulatory Support: Strong oversight by the State Bank of Pakistan and other regulatory bodies to ensure transparency, accountability, and alignment with national priorities.

Dr. Hussain’s contributions to the field of Islamic finance reflect a rare combination of academic rigor, visionary leadership and practical insights. His keynote address not only laid out a comprehensive roadmap for Pakistan but also provided strategic insights for the global Islamic finance community. By advocating for a holistic approach that prioritizes ethical principles, social impact and innovation, he has reaffirmed his role as a leading voice in Islamic economics.

The principles and strategies outlined by Dr. Hussain have implications far beyond Pakistan. As many Muslim-majority countries grapple with the challenges of integrating Islamic principles into their financial systems, Pakistan’s roadmap offers valuable lessons in legislation, innovation and capacity building. The focus on human capital, social impact, and genuine Islamization resonates with the broader objectives of Maqasid al-Shariah (the higher objectives of Islamic law).

Dr. Hussain’s keynote address at the WIEFC was a masterclass in envisioning a future-ready Islamic finance ecosystem. By addressing legal, economic and social dimensions, he has set a high bar for policymakers, academics and practitioners. His emphasis on innovation, collaboration and ethical governance underscores the transformative potential of Islamic finance, not just for Pakistan but for the entire Islamic world, including Malaysia.

Dr. Kamarul Zaman Yusoff was a participant at the 8th World Islamic Economics and Finance Conference (WIEFC), representing Universiti Utara Malaysia and The Future Research Centre.