Honorable Leaders, Industry Experts, and Fellow Malaysians,

Malaysia stands at a crucial inflection point in its technological journey. While some have argued that we are “out of the race” in the semiconductor foundry sector, the reality is far more nuanced and hopeful. The semiconductor industry is not solely defined by nanometer-scale manufacturing; it is a vast and diverse ecosystem where Malaysia holds strategic advantages.

To focus solely on the impossibility of competing with TSMC or Samsung at the bleeding edge of 2nm and 3nm fabrication is to miss the bigger picture. The future of semiconductors is about more than just miniaturization — it is about More Than Moore. It is about power devices, specialty semiconductors, MEMS/NEMS, AI applications, and quantum computing. In these domains, Malaysia has unique strengths that can propel us forward.

Breaking the Myth: Why Malaysia is Not Out of the Semiconductor Race

1. The Future is “More Than Moore”

While Moore’s Law has driven semiconductor innovation for decades, we are now entering an era where performance is enhanced not just by shrinking transistor sizes, but by integrating new functionalities.

MEMS (Micro-Electro-Mechanical Systems) and NEMS (Nano-Electro-Mechanical Systems) are high-value semiconductor solutions that power sensors, actuators, and microfluidic systems. These are not dependent on extreme nanoscale fabrication.

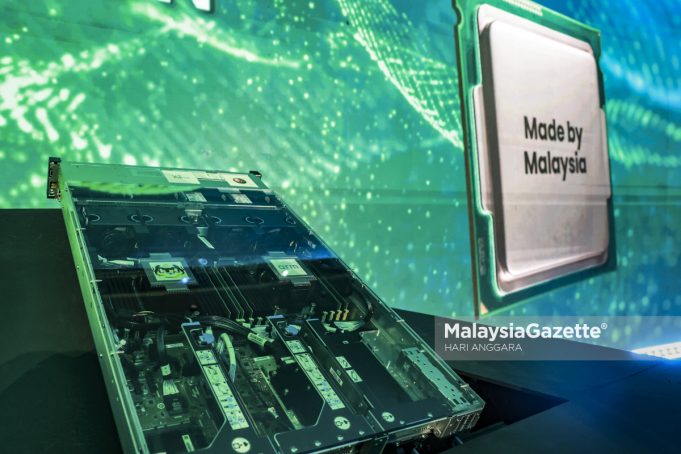

Malaysia, through MIMOS, Silterra, and other players, has expertise in MEMS technology, positioning the country as a leader in specialty semiconductor solutions.

Rather than chasing the 2nm race, Malaysia should focus on high-value semiconductor solutions tailored for industrial, automotive, and healthcare applications.

2. Power Devices: The Backbone of Modern Electronics

Not all semiconductors need to be tiny. Power electronics require robust and thermally stable chips, often fabricated on 8-inch wafers with 90-500nm nodes, making Malaysia’s semiconductor facilities relevant and competitive.

Advanced materials such as Gallium Nitride (GaN) and Silicon Carbide (SiC) are revolutionizing power semiconductors for electric vehicles (EVs), industrial automation, and renewable energy systems.

Companies like Infineon in Kulim, ON Semiconductor in Seremban, Fuji Electric, and Osram in Penang are expanding Malaysia’s power semiconductor manufacturing capabilities.

3. Chip Design: Malaysia’s Strategic Opportunity

The ARM and RISC-V revolution provides an unprecedented opportunity for Malaysia to leap into chip design.

ARM’s RM1.2 billion investment in Malaysia is a crucial first step, enabling local manufacturers to design customized chips for ASEAN markets.

RISC-V’s open-source architecture presents an even greater long-term opportunity, offering Malaysia a pathway toward semiconductor sovereignty without restrictive licensing agreements.

If Malaysia successfully integrates ARM and RISC-V into local semiconductor education, we can develop a new generation of chip designers who will drive the next phase of growth.

4. AI and Quantum Computing: The Next Frontiers

Malaysia has a unique opportunity to lead in AI chip optimization and edge computing.

While we may not manufacture cutting-edge AI chips like NVIDIA’s H100, we can develop AI models optimized for edge applications, IoT devices, and automation — sectors where Malaysia is already strong.

Quantum computing, led by UPM and establishment of Quantum Intelligence Center by MIMOS, represents strategic long-term bets. With early investments, Malaysia can position itself as a regional hub for quantum research and post-quantum cryptography.

Malaysia’s Market Challenge: The Need for Our Own Electronics Brands

While Malaysia has semiconductor design capabilities, one critical issue remains: Where will these chips be used?

Without a strong local consumer electronics or industrial technology sector, Malaysian semiconductor firms struggle to scale globally.

Nations like South Korea built their semiconductor dominance by establishing strong local brands (Samsung, LG, Hyundai) that created domestic demand for chips.

Malaysia must develop homegrown electronics brands in consumer tech, EVs, automation, and IoT to serve as a reference market for our semiconductor industry.

Without this market-driven ecosystem, even the best chip designers will struggle to commercialize their innovations.

A Strategic Plan: Building Malaysia’s Semiconductor Ecosystem

1. National Semiconductor Task Force: A Quadruple Helix Approach

A high-level task force should unite industry leaders, academia, policymakers, and civil society to develop a 10-year Semiconductor Master Plan.

This task force must ensure alignment between national R&D strategies, talent development, and market-driven commercialization efforts.

2. Co-Investment in Malaysian Chip Design Startups

The government should match private investments in semiconductor startups, following successful models from Taiwan and Singapore.

Priority should be given to AI chips, power semiconductors, and niche high-value markets.

3. Talent Development: The 10,000 Engineers Challenge

Malaysia must produce 10,000 semiconductor and AI engineers by 2030, through university-industry collaboration, ARM/RISC-V programs, and overseas training initiatives.

A national chip design curriculum, developed with ARM, RISC-V, and major semiconductor firms, should be rolled out in universities.

4. Incentivizing Homegrown Consumer Electronics Brands

Malaysia’s semiconductor industry can only thrive if local demand exists.

The government should provide incentives for Malaysian companies to develop local smart devices, EVs, and IoT products.

This will create immediate demand for Malaysian-designed chips and establish credibility in the global market.

5. Global Integration and Strategic Partnerships

Malaysia should secure direct partnerships with leading semiconductor firms to integrate local companies into the global supply chain.

This includes joint ventures with ARM, TSMC collaborations on specialty foundry work, and AI partnerships with NVIDIA and AMD.

The Path Forward: A Call to Action

We cannot afford to be passive observers in the semiconductor race. The world is changing rapidly, and nations that control their semiconductor industries will control their economic futures.

Malaysia already has world-class semiconductor talent, infrastructure, and manufacturing capacity. What we need now is bold leadership, strategic investments, and an integrated market-driven approach.

To those who say Malaysia is “too late” to the game — I say this:

Did Taiwan wait for permission to dominate chip foundries? No.

Did South Korea hesitate to build its own electronics empire? No.

Did China give up on semiconductors despite US restrictions? No.

Neither should Malaysia.

The path ahead is challenging, but it is ours to shape. With strategic vision, coordinated execution, and unwavering determination, Malaysia can rise as a semiconductor powerhouse — not just in assembly, but in innovation, chip design, and cutting-edge applications.

This is our moment.

This is our time to lead.

With determination and unwavering belief in Malaysia’s potential,

A Malaysian committed to national progress and technological sovereignty.

“The best way to predict the future is to create it.”

— Dr. Saat Shukri Embong is the Acting President and Group Chief Executive Officer at MIMOS Berhad, with over 30 years of experience in Malaysia’s semiconductor industry.